China’s Trade War: Electric Vehicle Ascendance?

(7 minute read)

- China’s rapid growth in affordable electric vehicles is disrupting the global auto market.

- To offset slowing domestic demand, China is aggressively exporting EVs, leading to trade disputes with Western nations.

- Western countries have imposed tariffs on Chinese vehicles to protect domestic industries; while China counters these measures, escalating trade tensions have emerged.

By Yassa Ahmed

China’s strength in the car market has been a relatively new concept. Dominated mostly by foreign car manufacturers, for a large part of the automobile’s life. Shining the names of Western countries: Germany, Italy, France and Great Britain.

Yet, this has steadily changed since 2019. China has become renowned for its cheap and affordable battery electric vehicles (BEVs), plug-in hybrid vehicles (PHEVs) and fuel cell electric vehicles (FCEVs) that are shaping a renaissance in the middle kingdom, but more importantly, disrupting the delicate balance of the global car market.

As the domestic supply of electric vehicles sores and the consumption base shrinks, export abroad has become a strong incentive to win new buyers, at the expense of established industry titans. As fears grow by Western nations that their countries will become ‘dumping grounds’ for cheaply manufactured vehicles, a trade war has emerged.

Western nations hoping to preserve competition in the market and China labelling them as dishonest practices, has resulted in tariffs impacting different areas of bilateral and multilateral trade. How has car manufacturing tilted in China’s favour and are tariffs enough to stunt their ascendents?

Growth of China’s EV Automotive Industry

The story began in the 2000s, when Wan Gang, dreamed of the nation as a leader of technology and clean energy, one that would have a strategic edge in the automotive industry over competitors. As minister of science and technology, Wan brought forth great interest from entrepreneurs connected to green vehicle creation through “indirect subsidies to car companies and battery makers in the form of tax cuts and cheap land for factories.”

Local government subsidies for electric buses and a slow hybridisation of combustion and green made it easier for citizens to get assistance in purchasing their first clean cars. Structural changes became active. An enthusiastic proposal was being made, by the Chinese government, to make EVs a national priority.

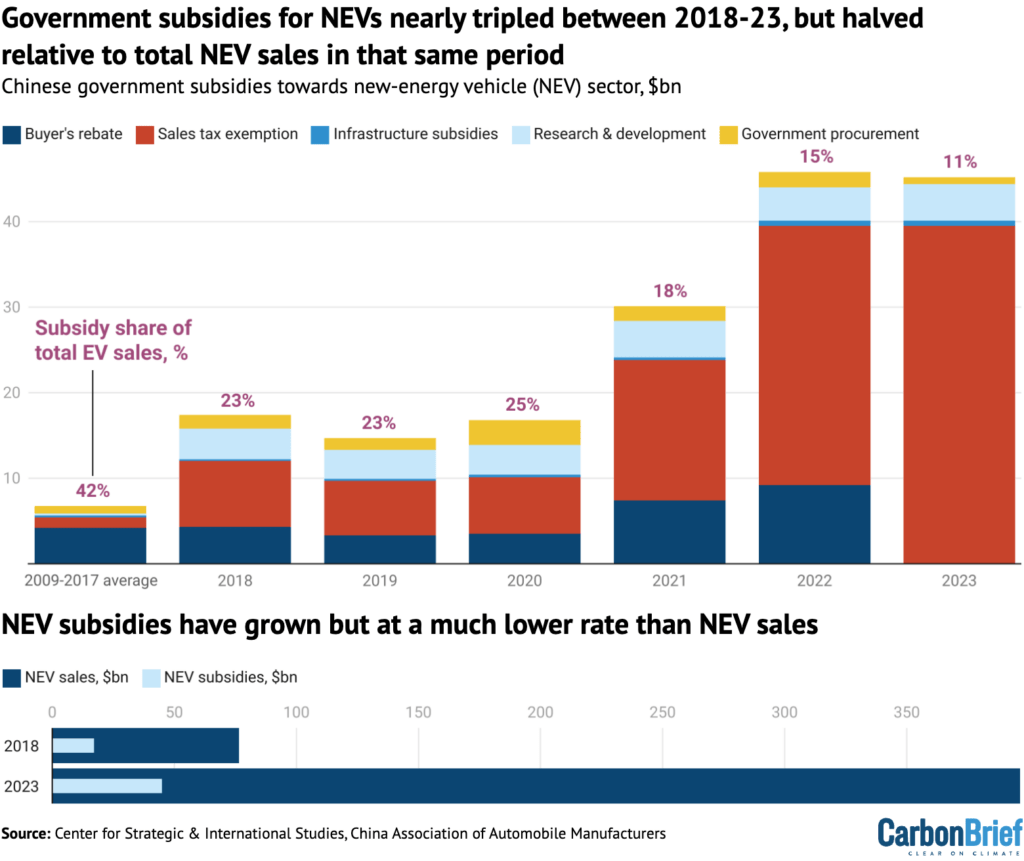

Large-scale investments climbing to $60 billion between 2009 and 2017 grew the industry, as policy drove a revolution. A broader mind outside of fixed approaches to energy use signified the country’s transformation from “Made in China to Invented in China” stated Xu Guanhua.

Domestic competitors, Nio, BYD, SAIC and Xpeng have accelerated the pace of a diversified playing field of global car giants but altered the dynamic in order to seek lower costs and wider markets. Some Chinese EV makers used the purchase of established brands, MG, Volvo and Geely to increase their presence and reputation. This has brought opportunities for car manufacturers at home to make full use of international identities, introduce themselves as market movers and improve the overall level of EVs in China.

Shrinking Domestic Market: Global Dreams

In 2021 car sales were 0.5 million, 40% of the market, in 2023 China’s electric car sales were 2.7 million, 60% of the total market. Chinese automakers quarter on quarter growth for the last 3 years was strong but began to drop at the beginning of Q1 2024. Indeed, the government released “a comprehensive economic revival”…”to support private enterprises” said President Xi Jinping adding stimulus and subsidies to manufacturers.

Sluggish economic growth and the extensive effectiveness of the Chinese industry, in producing more EVs than domestic consumption can support, have created an overcapacity problem. This shifted car titans to pursue foreign economies to alleviate internal malaise. Furthermore, exporting abroad has become an attractive alternative to an intensifying domestic market with fewer buyers for large and small car makers.

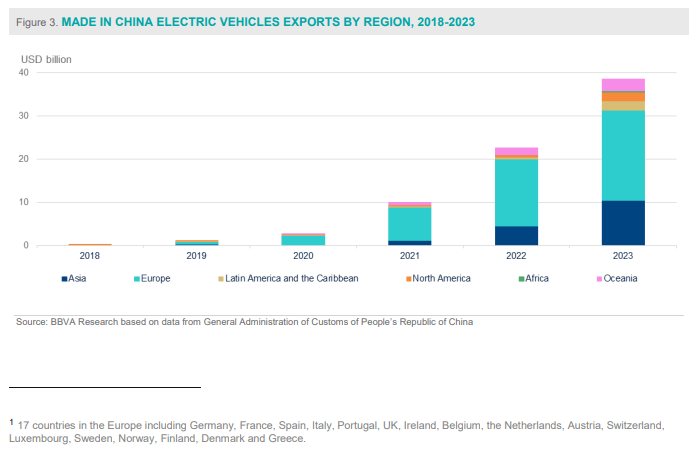

The CCP serves to benefit from international trade as it unlocks its overcapacity issue, but secondly, as a conduit of stronger public confidence, adding security to its competitive advantage over the West. The World Economic Forum found “respondents say that they would consider a Chinese EV if priced 20% lower than a similar non Chinese model.” High income countries have increased their share of Chinese EV exports by volume by 20% in between the years of 2022 to 2023.

Domestic EV manufacturers have been improving the quality of their EV offerings to foreign economies. Exports grew remarkably in 2023, with a 70% increase at a value of USD 38.5 billion. With a high level of specialisation at a lower cost, innovative momentum has catapulted EVs with Chinese characteristics to civilians across national borders.

Protecting Competition: Anti-Dumping

The general nature of US-China relations has been bullish since 2018. “China’s unfair trade practices concerning technology transfer, intellectual property, and innovation are threatening American businesses and Workers” writes a statement from the Biden-Harris administration. Trade restrictions on critical resources and technologies have slowly increased over the course of the last 6 years.

However, this administration has quadrupled tariffs on EVs bringing the current rate to 100%. Some Analysts consider that the latest tariffs have been an admission by Biden that “past measures have failed to prevent China from galloping ahead” and have put the US in a precarious position. Washington views that the gains made by Beijing have been unfair.

A thievery of compulsory technology transfers or theft of intellectual property has compiled, in their view, against China. Yet, data from the World Industrial Property Organisation logged total invention patents at 558,000 with China accounting for 31.9%, far greater than the EU and US within the period of 2016-22.

So are these merely symbolic? “Chinese EVs can actually take jobs away from a lot of manufacturers in, say, the West,” says a senior analyst on China and Asia, Chim Lee. But these rounds of tariffs also serve mainly to “generate U.S. government revenue without cutting off imports of needed products” with the higher ones “designed more explicitly to shut out some products entirely” writes Charles Benoit, trade counsel for the Coalition for a Prosperous America.

There might be truth, in that, these tariffs stave off a dumping of the American economy. Indeed, the United Kingdom has embraced Chinese manufacturers, with the Society of Motor Manufacturers and Traders finding Chinese-made EVs have raised from 2% in 2019 to 33.4% in the first half of 2023 in the UK. However in the case of Britain, their domestic EV car production is relatively barren, so concerns of dumping have not been attacked as heavily over there. Ultimately, geopolitical considerations have most likely dominated US economic policies against China.

Can China Maintain Their Advantage?

A brotherhood of the West has enacted tariffs on Chinese EVs not just the United States. The European Union increased restrictions on Chinese EVs to 45.3% in October, one year after starting an anti-subsidy probe, with Tesla at 7.8% to 35.3% for the Chinese car manufacturer SAIC on top of the standard 10% car duty. The Canadian government has implemented a 100% surtax on all Chinese-made EVs; “electric and certain hybrid passenger automobiles, trucks, buses, and delivery vans” in the same period as well.

For Beijing, it seems hardly unmotivated by these tariffs, and China has fought back and begun initiating probes and investigations into Western exports to their nation. China imposed taxes on imports of European brandy at as much as 39% dropping the shares of “French distiller Rémy Cointreau down more than 9% and the Hennessy Cognac owner LVMH down 6.8%. Pernod Ricard dropped 4.6%” states the Guardian.

Yet, this tit-for-tat approach has made both parties realise that they may need to look “for a mutually agreeable solution compatible with World Trade Organisation (WTO) rules.” Unlike the unitary state of China, member states of the EU have differing feelings towards tariffs.

The Middle Kingdom’s strength lies in its numbers. Its overcapacity problem might be worrisome for high-income countries, but for developing economies or markets that do not have their own domestic EV production, China has options. As tariffs grow elsewhere, Chinese-made vehicles are heading to countries like Australia, displacing titans like Tesla for more affordable cars like the MG 4.

Despite troubling geopolitical considerations, China still has a vast hand to play in car manufacturing. Especially as it is the dominant leader in green vehicle tech in a world that is increasingly more and more fixated on climate change and our stewardship of the environment.