Coal’s Countdown: America’s Energy Transformation

- Market forces and policy pushes US power shift.

- Inefficiency and competition drive coal’s diminishing role in US energy.

- Coal faces uncertain future as US embraces renewables and reduces emissions.

By Yassa Ahmed

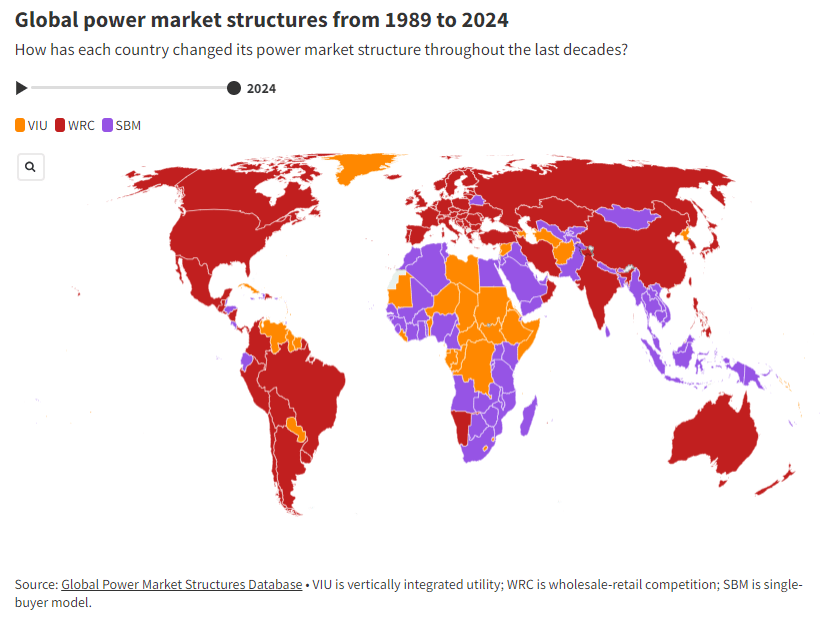

The global power market has seen an incredible transformation in its structure over the last 35 years. A single entity in 1989, controlled (in their nations) all aspects of electricity generation, transmission, distribution, and retail sales as vertically integrated utilities (VIUs) for 159 economies.

In 2024, only 72 economies remain as VIUs, while the majority have shifted to a mix of competition-based models. With investment lags, lack of competition, low efficiencies, and higher losses, the market ultimately spelled the downturn of this structure.

Market design was and has been altered by participation through public and private companies. This means even the traditional backbone of the power sector, coal, has seen its influence wane to private independent power producers (IPPs) interested in improving return.

For Washington, the opening of the domestic power market is one aspect of many that sees traditional power generation technology decline in the United States of America.

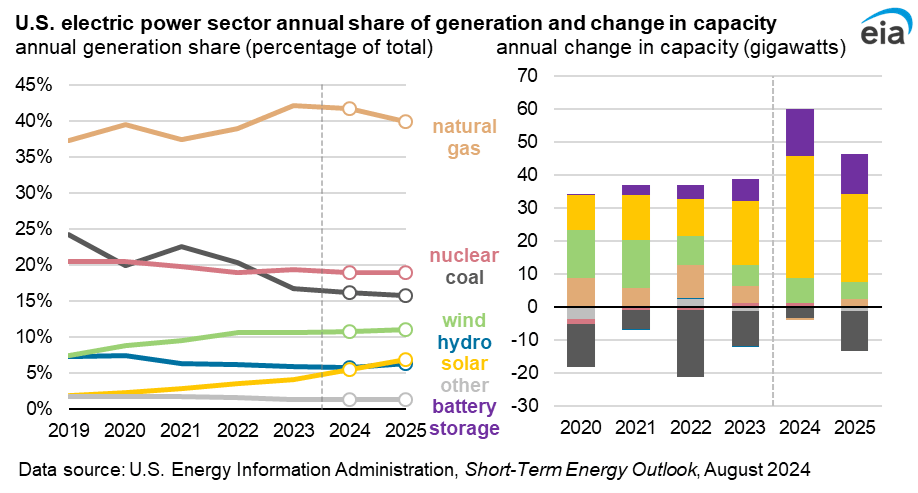

The US electricity generation mix has shifted away from their primary fuel source of coal, towards natural gas and renewables. In 2019, coal made up 25% of U.S. electricity generation, 5 years later it made close to 17%. A trend has emerged as it continues to decline, with it forecasted to reach 15% of annual generation in the United States by 2025.

If we assess a levelised cost of electricity (the estimated amount of money that it takes for a electricity generation plants to produce kilowatts an hour of electricity), we can find that coal has a higher relative fuel cost than competing energy sources (figures 1 and 2).

The operating costs associated with competing electric power are significant factors for IPPs to generate electricity and sell to national power companies or wholesale purchasing agencies. The countries largest wholesale electricity market, PJM, has decreased its coal fleet over the last decade by 2023 to 34% of capacity as a result of coal’s inefficiency.

Natural gas has applied competitive pressure on coal, with a relatively low natural gas price of US$/MMBTU 2.13 and a combination of stricter emission standards, and more efficient natural gas turbine technology, have all but exacerbated coal’s inefficiency.

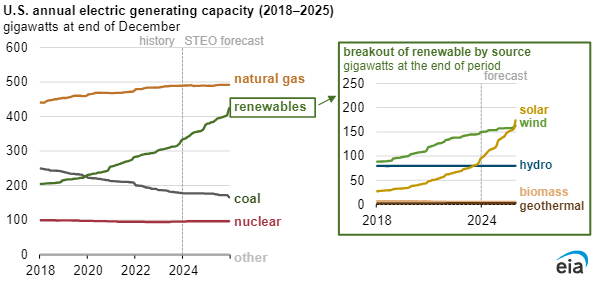

This has seen the domestic usage of natural gas uptick to 42% in the middle of 2022, and remain robust in 2025 at 40%. Yet, the fastest growing source of electricity in the United States is not natural gas but renewable energy. Wind and solar energy will lead growth in U.S. power generation for the foreseeable future.

As the U.S. Energy Information Administration (EIA) forecasts the growth of solar power generation by 75% from 2023 to 2025, with new solar projects coming online this year. Furthermore, wind power generation see itself grow 11% for the same time period.

This is in contrast to coal power generation declining 18% from 2023 to 2025. So is it a matter of efficiency and market pressure that is completely to blame for the continued decline of coal? PJM operators are already planning to retire nearly 20% of current coal capacity by 2028. Can we reflect this change some other way?

As early as 1993, President Clinton declared new U.S. policies for the environment echoing a sentiment that America would still be fighting. In 2023, President Biden convened leaders of the Major Economies Forum on Energy and Climate, with an aim to galvanise efforts to keep a 1.5°C limit on warming within reach.

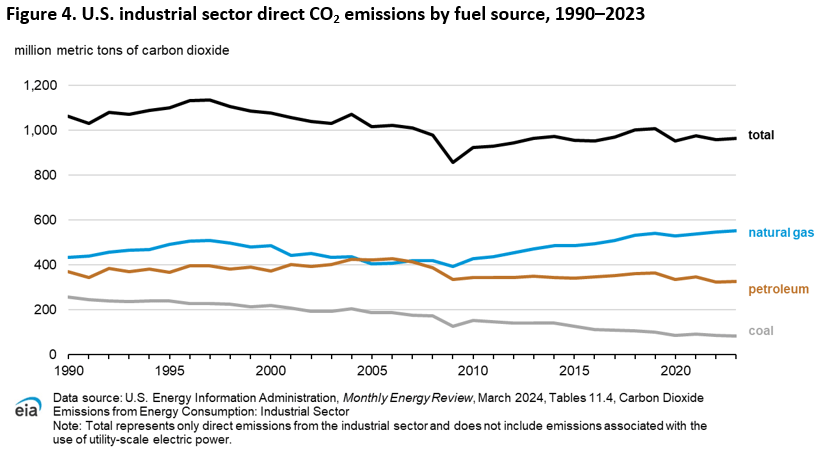

Climate crisis has continued to be a dominating force on domestic energy prices, with ambitions to slash emissions by 50-52% in 2030, decarbonising energy particularly in the power and transport sectors. Indeed, in 2022, 60% of total annual U.S. utility-scale electricity net generation was made up of power plants that burned coal, natural gas, and petroleum fuels.

This accounted for 99% of U.S. CO2 emissions, with close to 600 million metric tons of CO2 from natural gas existing into the earth around 2023. A known decrease in emissions through coal but fossil fuels remain a persistent problem.

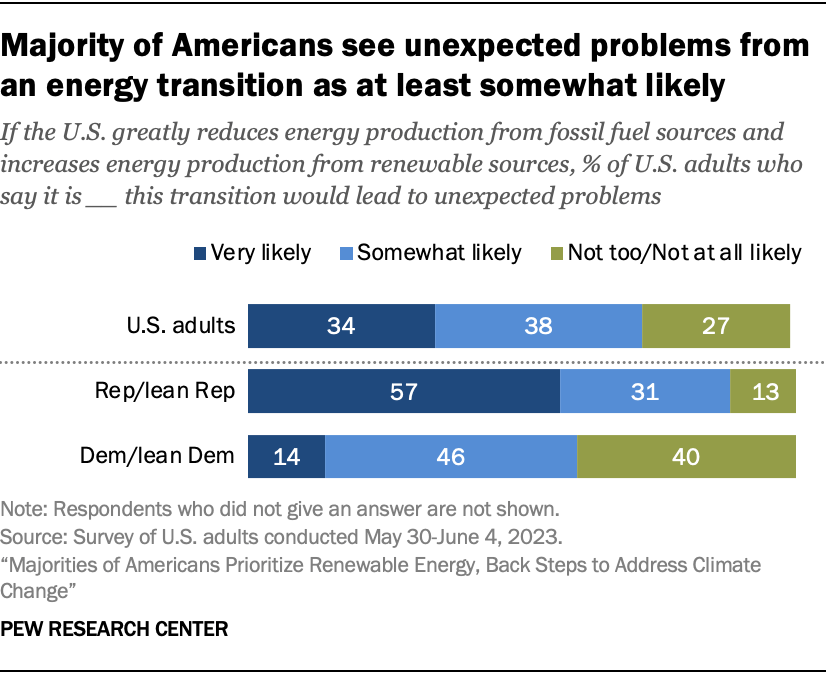

Concurrently, while 67% of Americans say the U.S. should prioritise developing alternative energy sources, Pew Research Center found that 32% of Americans thought the U.S. should expand the exploration and production of oil, coal, and natural gas.

Furthermore, the % of U.S. adults who say the U.S should never stop using fossil fuels is also 35%. This is not to skew the general consensus, that Americans prioritise renewable energy, it shows that their is some work to be done to convince all Americans of an energy transition.

However, the Biden administrations goals: reaching 100% carbon pollution-free electricity by 2035, achieving a net-zero emissions economy by 2050 and delivering 40% of the benefits from federal investments in climate and clean energy to disadvantage communities, will set solar and wind power to climb in total power generation for the U.S. relative to coals continued decline.

Policy and social consciousness, therefore, is affecting power generation but on a slowly developing front compared to market forces.

Is this the end of coal? Geopolitics expert, Peter Zeihan, thinks otherwise. He believes that if there is any future for American coal, it’s not going to be in America.

In a world of globalisation, international trade is a given, but he states, “oil and natural gas are the low carbon fossil fuels that are internationally traded.” If the international system is broken, the ability of to source those two fuels by countries around the world becomes harder.

In an environment like that, U.S. natural gas, oil and even coal will be given a new lease on life – “it just won’t be burned here,” says Zeihan. Coal, for now, is on the decline and we hope to have helped you understand the inner workings of the power market, energy sources, and where Washington might be headed in the future.