DeFi and CBDC: The Future?

- Transforming commerce with decentralised finance and central bank digital currencies.

- Introducing security risks in DeFi and CBDCs.

By William Willis, Michael Manners and Open-AI

Change is on the horizon for many of us in the financial world. Driven by the emergence of decentralised finance (DeFi) and the exploration of central bank digital currencies (CBDCs), these developments have significant implications for the future of finance, as they reshape traditional systems and pave the way for new opportunities. Today, we will have a co-writer, Open-AI, join us today as it only makes sense to have one digital tool discuss another. Supporting me to highlight key trends, challenges, and potential implications for the financial industry.

DeFi, a comprehensive term encompassing a diverse array of blockchain-based financial applications, stablecoins, software, and hardware, has witnessed remarkable traction in recent years. Notably, the advent of Bitcoin and Ethereum in the 2010s has served as a powerful catalyst for the expansion of DeFi. Within this decentralised ecosystem, a multitude of services flourish, such as crypto exchanges, lending and borrowing platforms, derivatives, and insurance offerings. The allure of DeFi lies in its accessibility, minimal transaction fees, and the potential to generate passive income, which has attracted participants from both retail and institutional sectors.

While DeFi presents exciting opportunities, it also faces several challenges. Research done by the Association for Financial Markets in Europe (AFME) in their latest report notes the concern in the volatility of cryptocurrencies, which can pose risks for investors. Additionally, the lack of coherent regulations and governance structures introduces uncertainty and potential vulnerabilities. Cybersecurity threats, such as smart contract vulnerabilities and hacking incidents, have highlighted the importance of robust security measures. However, these challenges have not deterred the growth of DeFi, as it continues to push the boundaries of innovation and financial inclusion.

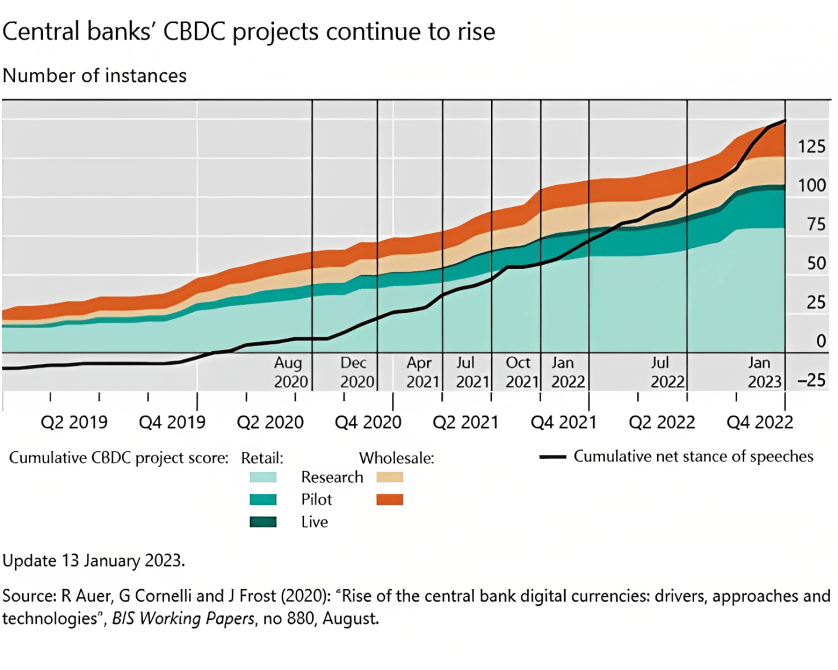

In response to the rise of private cryptocurrencies and the evolving financial landscape, central banks around the world are exploring the potential of CBDCs. These digital representations of fiat currencies offer advantages such as faster and cheaper transactions, increased financial inclusion, and reduced reliance on cash. CBDCs wants leverage technologies such as distributed ledger technology (DLT) and smart contracts to provide a secure and efficient means of conducting transactions. Several countries have already initiated CBDC pilots and implementations, with a focus on security, stability, and regulatory compliance.

However, if CBDCs look to regulate or utilise aspects of DeFi and private cryptocurrencies, it must establish robust security protocols to protect against cyber threats and maintain public trust. In an analysis conducted by the Bank for International Settlements (BIS) on DeFi attacks, employing frameworks like MITRE ATT&CK, it was observed that existing threat modelling techniques may possess deficiencies in adequately addressing the threats and security controls necessary to protect CBDCs that leverage innovative technology. Indeed, the decentralised nature of DeFi platforms, as stated above, introduces risks, particularly within supposedly secure smart contracts, leading to potential vulnerabilities and instances of hacking.

It is evident that existing techniques may not sufficiently address the threats and associated security controls required to protect CBDC systems utilising DLT or smart contracts. Nevertheless, the growth of decentralised finance and the exploration of central bank digital currencies signify a significant shift in the financial industry. While both DeFi and CBDCs present challenges and opportunities, the winds of change blow in a virtual direction, so we ought to carefully observe.