Ireland’s Shadow Banking

- Ireland’s shadow banking sector experiences remarkable growth.

- Sector’s lighter regulation poses risks on excessive leverage and liquidity.

By William Willis and Michael Manners

Ireland has emerged as a significant player in the global shadow banking industry, hosting a substantial and rapidly expanding non-bank financial sector. While the term “shadow banking” may evoke a sense of mystery, it refers to a wide range of financial activities and institutions operating outside the traditional banking system. With assets totalling over €2.3 trillion at the end of 2017, and signalled to be much large in 2023, Ireland’s shadow banking sector has witnessed remarkable growth. Dublin is in a special arena, poised to wonder what non-banking, its associated risks, and the regulatory efforts in place are to have for the nation.

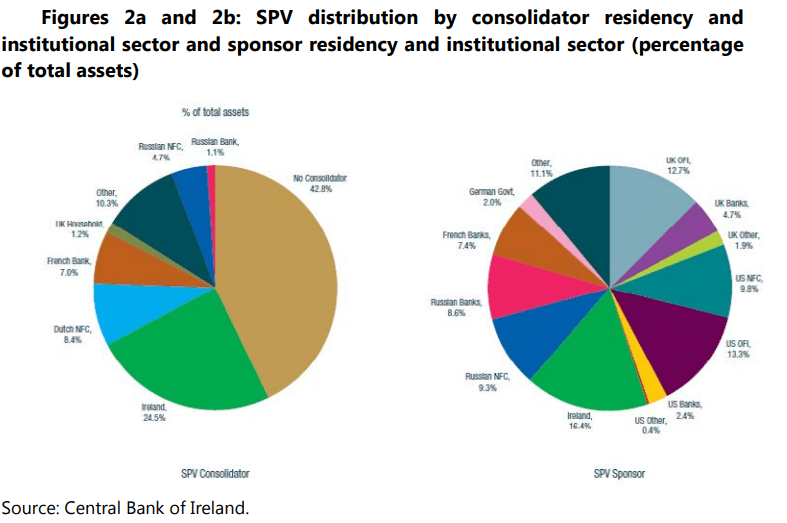

The Irish shadow banking sector primarily consists of non-bank financial intermediaries, such as investment funds and special purpose vehicles (SPVs). These entities engage in various activities, including securitisation, money market funds, and investment funds. While the Financial Stability Board (FSB) defines the sector, it excludes segments like equity funds, insurance activities, and pension funds that do not pose risks to financial stability.

Shadow banking presents both benefits and potential risks. On the positive side, it offers alternative sources of credit and liquidity outside traditional banks, fostering financial innovation and diversification. However, the sector’s lighter regulatory oversight exposes it to risks, such as excessive leverage, inadequate risk management, and liquidity mismatches. Moreover, the interconnectedness between shadow banking and traditional banks can amplify systemic risks, as witnessed during the 2008 global financial crisis.

In Ireland, a significant portion of the shadow banking sector is comprised of special purpose vehicles (SPVs) used for securitisation purposes. These SPVs facilitate the bundling of loans into asset-backed securities. Securitisation allows banks to remove loan portfolios from their balance sheets, potentially reducing loan costs for customers. However, it also carries the risk of excessive debt accumulation and challenges during periods of market stress.

Recognising the potential risks, Irish authorities, led by the Central Bank of Ireland, have been proactive in addressing shadow banking concerns. They have called for stronger global rules and an overarching regulatory framework to contain risks and promote financial stability. Efforts are underway to enhance liquidity risk management in money market funds and open-ended funds. However, challenges persist in establishing comprehensive global standards due to the diverse nature of institutions falling under the shadow banking umbrella.

While the Irish shadow banking sector has limited links to the domestic economy, the Central Bank of Ireland remains committed to managing potential risks and ensuring financial stability. However, the ECB has commented stating shadow banking “sectors expose banks to liquidity, market and credit risks, with liquidity risk seeming to be the main concern at present. The materialisation of liquidity and credit risks in the…” “sector would lead to an outflow of the funding provided by this sector.”

Ireland’s shadow banking industry has experienced remarkable expansion, positioning the country as a significant player in the global non-bank financial sector. Regulatory efforts are underway to address the unique challenges posed by shadow banking, with a focus on enhancing risk management, liquidity, and global standards. By closely monitoring and managing potential risks, Ireland aims to navigate the complex landscape of shadow banking and safeguard its financial system.