The Alternative to Common Investments: A Dive into The Art Market

(9 minute read)

- Crypto wealth is fuelling liquidity in the global market, as fractional ownership platforms are increasing accessibility for average investors, art has grown in popularity.

- The wealthy are driving the art market, with art assets estimated to reach US$2.861 trillion by 2026.

- Volatility and long hold periods are significant concerns. Investors should carefully consider their risk tolerance and diversify their portfolios accordingly.

By Yassa Ahmed and Michael Manners

As cryptocurrency has reached its zenith in the current bull run, Bitcoin topping off at US$100k+, much is to be won for those who can successfully capitalise when the eventual sell-off happens and greater liquidity occurs in the market. With pockets lined with money, smart or even common investors will look to shift gains made to hard assets—condos, duplexes, homes, the list goes on. Indeed, the housing market might be the best choice, with it being relatively low in places like Canada or America.

However, those with enterprising skill sets and more uncomfortable with the not-so-common may turn their heads to the art world. A report by Art Basel & UBS Survey of Global Collecting 2024 found that “total expenditure on works by new and emerging artists increased by 8% in 2023/2024 to 52%.” Furthermore, the report found that globally, art sales have slowed outside of China, where they continue to rise.

In today’s world, you do not need to own the paintings outright but can own sections of them like shares in a company. With a global art market at a reasonable price point and liquidity being made available through crypto currency, is the next best investment not homes but artwork in 2025? We will examine the trend of the art world, how it has made people wealthy, and if the investment is sound enough for regular individuals to participate in.

Art Markets and Economics

Jonas Wood, the bold quasi-abstract artist from America, is a talent of creative and lucrative means. The desirability of his art can be seen in the initial offerings of his still life paintings from 2010 to 2021, which saw a sizeable jump from a 2015 piece sold for US$600k, and another in 2021 sold for US$4.7 million. Does that mean the past performance of previous works is a conclusion for future works? Not quite. It more closely demonstrates the value of art and the annual growth an artist can achieve for investors.

Examining the Fine Art Market, over the last couple of years, we can see that it exceeded the S&P 500, growing nominally 4.2% compared to a 6.6% loss for the S&P 500 between January 2022 and July 2023. The rate of compound annual growth (CAGR) for European Old Masters (European artists born from 1250-1820) saw an increase of 2.9% in the last 5 years, with its market performance by mid-2023 growing by 6%, via a Deloitte report. It also found the genre had the best 12-month return over the period, with 9.7% in 2022 year-over-year.

Yet, ‘following two years of growth, the total value of sales in the art market slowed in 2023, falling by 4% as sales were thinner at the top end of the market, and the performance of some of the major art markets diverged’ found Art Basel & UBS. A closer look at the market shows that art movements are not equal in their investment strength. Deloitte concluded that “looking deep at the return on investment over different time periods, all sector price indices show a mostly negative CAGR in the long run.”

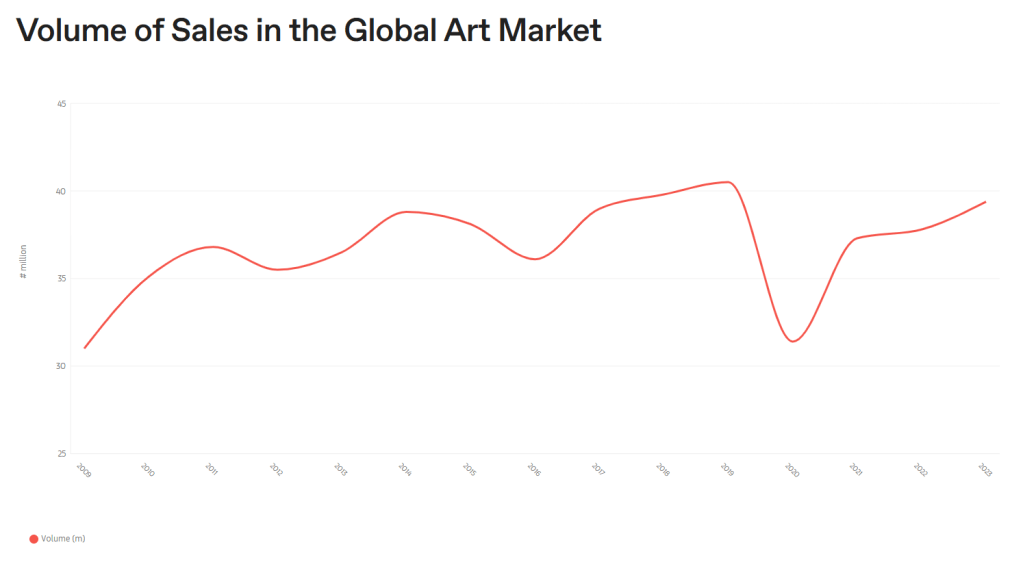

Indeed, the volume of sales in the global Art Market peaked at USD$42 million in 2019 and slumped to just under USD$40 million by 2023 (as seen above), transactionally, art has seen itself grow, driven mostly by purchases at lower price levels for both dealers and auction houses. This suggests a climate of lower-risk purchases, partially for the personal enjoyment of art over direct investing, demonstrating the volatility in luxury pieces.

Art Collectibles and The Wealthy

So why have Ultra-High-Net-Worth Individuals (UHNWI) expanded their wealth associated with art and collectibles if the market demonstrates volatility? In 2022, UHNWI’s art and collectible asset value was estimated at US$2.17 trillion. Deloitte predicts that this figure could “grow to an estimated US$2.861 trillion in 2026, due to the increased number of UHNWIs across the world.”

The growth of global billionaires has increased. Art as a financial tool has seen itself more readily integrated into luxury assets managed by UHNWIs’. For many, the art and luxury sectors, have proven more resilient than other consumer goods, such as clothing or vehicles, to economic downturns; even though the value of pieces has declined somewhat since 2022/2023. Moreover, UHNWI’s wealth has been, to a degree, insulated from the economic stress of the pandemic (though still impacted due to ongoing wars and geopolitical conflicts).

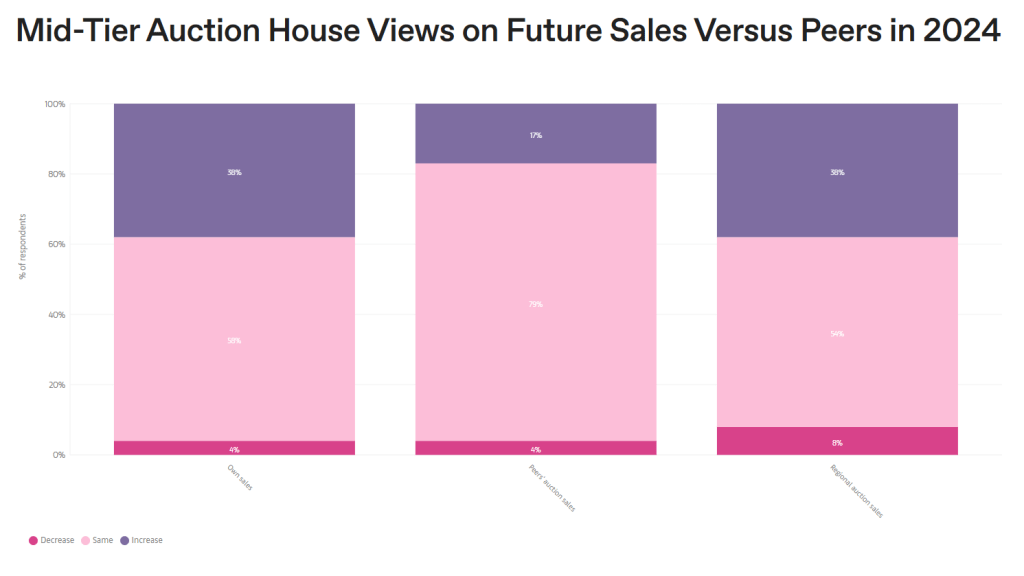

We can see further that, in some regions, High-Net-Worth (HNW) collectors use credit or lending to purchase works, as falling interest rates in 2024 have spurned easier borrowing and spending, ‘undoubtedly viewing any drop in rates as a positive development,’ states Art Basel & UBS. The ability of the wealthy to leverage their real or borrowed incomes to buy art and other assets to seek better returns vis-à-vis the cost of borrowing is a key strategy for UHNWIs to maintain and expand wealth.

Art attracts more scarcity, uniqueness, and illiquidity that separates it from other goods. Indeed, luxury jewellery, handbags and watches have a high entry point that creates reasonable exclusivity and differentiation, however, serve a “more mass-market audience with a more instantly replenishable supply of often new products” goes the Art Basel & UBS report. For the HNWI and UHNWI, the increasing commodification of art is only necessary to the benefits it can hold compared to other consumer goods.

Art Investment Funds and Fractionalisation

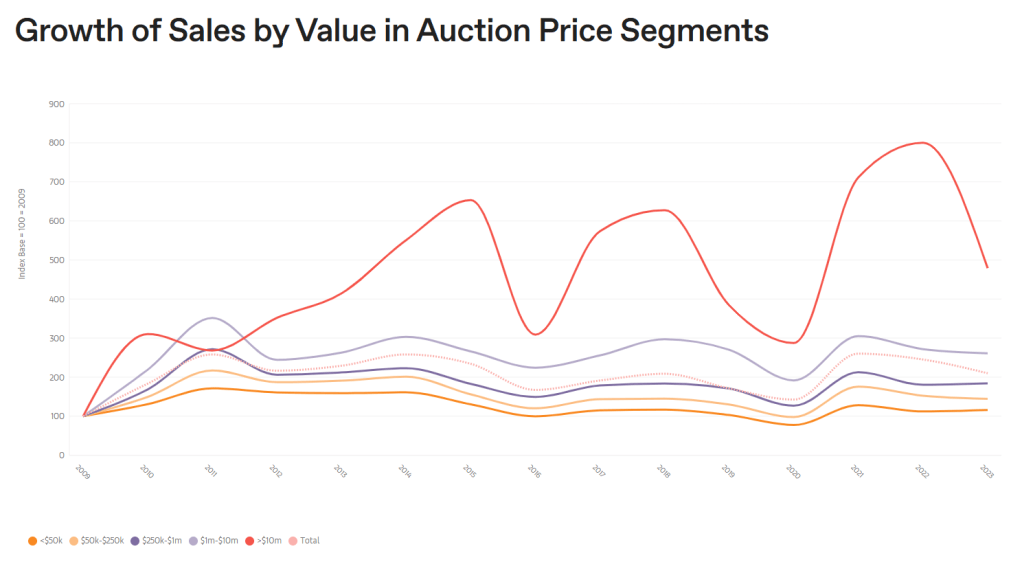

Jonas Wood’s creativity is immense and almost out of reach for regular investors. From 2021 to 2022, the largest segment of sales was artworks priced greater than USD$10 million, hardly an amount a ‘mom and pop’ investor could muster in time to purchase at the nearest auction. However, our interpretations of outright ownership have shifted, and the development of this ‘sharing economy’ has allowed access and usage of pieces to more individuals than ever.

Deloitte states that fractional ownership “allows buyers to expand and diversify their asset base,” a manifestation of the sharing economy by “reducing maintenance costs, purchase prices and risk based on only partial ownership.” Fractional ownership mitigates high costs associated with acquiring expensive assets, like art, by allowing investors to participate in smaller investments, opening the demographic pool of investors.

Masterworks represents just under US$815 million of assets under management of SEC-regulated art products that can be fractionally owned by investors. Over the course, of its founding, interest in fractional ownership of collectibles has grown, offering investors a variety of 300 artworks. As price inflation has risen over the past decade, investment-grade art has a new lease on life for collectors who do not need to purchase outright.

While seemingly positive, “despite recent traction in this market”, goes Deloitte, “art market and wealth managers are yet to be convinced by fractional investment models.” 34% of art professionals expressed an interest in the model, 21% of collectors found the same, and 23% of wealth managers (down 6% from 2021) still had an interest in these products for their clients, due to their clients still showing resistance to the idea of fractional ownership as an investment vehicle.

Your Portfolio and Risk Management

The fractionalisation of art as a security has garnered more investing eyes from regular people wanting to be able to diversify their portfolios. Companies like Masterworks have benefited greatly from this interest in the art world, but that has also meant that average investors have to be wary of the CAGR of various collecting categories. While European Old Masters performed well between 2022-23, its 15-year CAGR was -0.8%, (better than other sub-classes, but not positive over a long stretch) according to Artnet’s Index on Fine Art and Gold.

As the next generation of art collectors pass to the next, so do their evolving tastes, particularly, for those inheriting substantial wealth who anticipate a closer relationship to contemporary art. The appreciation in the value of artists like Jean-Michel Basquiat and Adrian Ghenie, with Adrian achieving a 444% increase in value, has astonished what art categories can produce as a return. Nonetheless, individuals who invest in companies that fractionalised any form of art have to contest with the relatively long hold periods that can range from 3-10 years, or if they intend to sell, to have to engage in the secondary market on a peer-to-peer level.

In some cases, the entry point towards investing in art can provide another barrier that many are not willing to take. Fine art is a high-risk investment with low liquidity and volatility that ranges between categories and favours UHNWI/HNWI who can afford to wait and potentially lose value in the short term, to maybe win in the long term. “We are more concerned that clients are less interested in the education component of collecting, and that so many people are now buying works of art for ‘image’ or because they feel art is a commodity they are supposed to want to collect” states the Art Basel & UBS report.

Is the viewpoint not to consider investing in art? No, it is to take it piecemeal in any investing strategy and weigh the pros and cons of adding it to one’s investment strategy. A reasonable slice of art investment can boost your total portfolio value without having to own a collection outright. If you have extra funds you are willing to part with, take your time and consider how its inclusion can affect your wealth management in the future.