The Grocery Squeeze: Coles & Woolworths

- Coles and Woolworths meet market dominance, with a combined share of close to 70%.

- Limited costs and pricing information makes it difficult to understand what is happening in the market.

- Closing gaps in policy to ensure unfair price hikes are eliminated.

By Yassa Ahmed

Price hikes down under have directly affected Australian households. Essential groceries have become a struggle, which has the possibility to reduce the food intake of locals and quality of food consumed, adding strain to the rising cost of living in Australia.

The undeniable pinch of rising costs is a harsh reality for many around the world, but in the case of Canberra, the squeeze is hardly talked about without considering the duopoly of Coles and Woolworths. By examining the market structure, price hikes, and consumer experiences, we explore how Australians are grappling with affordability.

The dominance of Coles and Woolworths has seen their combined market share dwarf that of their competitors, Metcash and Aldi. As competition becomes more fixed, a concentration in power creates a duopoly, where the two established industry giants could exert significant influence on pricing and supplier relationships.

As an assortment of suppliers face 70% market tilt towards two companies, the supermarkets may have sway over the sale price of goods to them. While competing on prices could lower prices for consumers, at the expense of the supplier, many have asked why consumer prices are still high.

If competition is meant to drive down prices for consumers, is the duopoly limiting this effect as Coles and Woolworth impact the overall market dynamics’, potentially allowing for price hikes?

Over the past few years, grocery prices have risen steadily, outpacing wage growth. Coles and Woolworths have argued that rising supplier costs, fuel prices, and global inflation are potential factors in this. ‘Excuse-flation’ – “where frequent, large price increases affect the ability of consumers to judge the fairness of prices and reject those which are excessive;” has been cited as a justification for higher prices, as businesses use external factors (such as inflation) when their own costs have not increased accordingly.

This has the effect of demonstrating how a duopoly allows supermarkets to inflate profit margins during challenging economic times. An inquiry has found that there is a lack of transparency around costs and pricing information for producers and consumers.

Furthermore, the Australian Competition and Consumer Commission (ACCC, the competition and consumer regulators) has no power to investigate whether grocery prices are excessive unless the government requires it to do so.

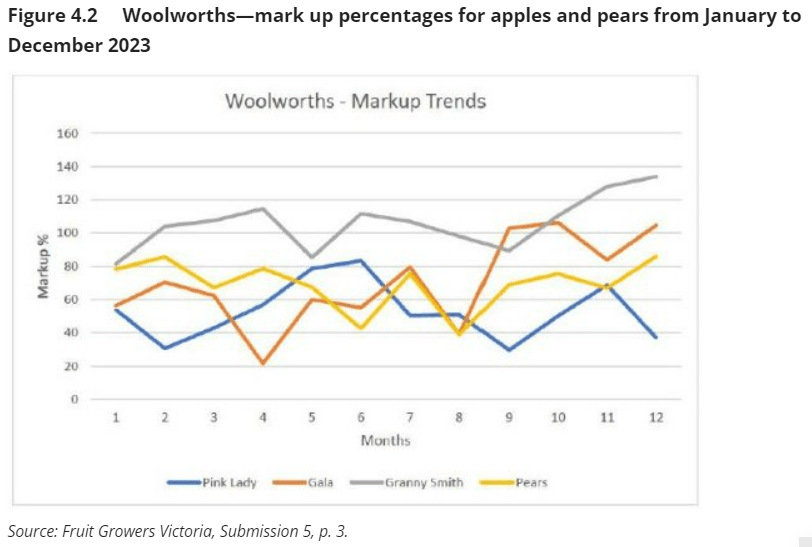

The impact of price hikes on consumers is glaring when you consider the total cost of a selection of apples, provided by Fruit Growers Victoria, saw Gala, Granny Smith and Pears markup past 80%. With affordability of essential groceries such a talk, news outlets are providing answers to reduce weekly grocery costs: buying in bulk, buying at the end of the day and evening expanding your search.

Groceries are becoming a significant portion of household expenses, impacting other essential needs. Public and political pressure on the duopoly has resulted in a number of recommendation from the select committee on supermarket prices. Recommending amendments to the Competing and Consumer Act 2010 to create divestiture powers specific to the supermarket sector. Amendments to prohibit the charging of excess prices.

Allowing ACCC the authority to investigate and prosecute unfair trading practices. Increase in ACCC to adequately regulate, investigate, and enforce and prosecute competition policy matters. While advancing policy to effectively set supermarket pricing practices on track and lead to more transparency is a part of the long road ahead.

This grocery squeeze has been in part allowed by governments’ in action to curb the duopoly’s power prior to the current state of affairs. Offering Coles and Woolworth to be put in to a position of question around their market activities for suppliers and consumers.

Alternative shopping options like Aldi provide a different business model that emphasises an economy of scale to allow for competitive price points. This successful penetration of the Australian grocery market provides consumers with an alternative shopping option, with the likes of Costco joining in too.

All in all, shedding light on the relationship between Coles, Woolworths, suppliers, policy, and the market demonstrates how you, the consumer, are affected by a factory of moving parts.

By empowering yourselves with knowledge, you can understand why you may have to navigate the grocery aisle during this challenging time and explore alternative shopping options that prioritise affordability.